If a Kaspi super app existed in the West, it would probably sit on top of half the companies we use every single day.

Just picture this, all in one app:

Payments & QR: $PYPL, $SQ, Apple Pay, Google Pay

Banking & savings: Revolut, Chime, Monzo

E-commerce marketplace: $AMZN, $SHOP, $EBAY

Grocery & delivery: $DASH, $UBER, Instacart

Travel: $BKNG, Expedia

Classifieds & real estate: AutoTrader, $Z

Advertising for merchants: $GOOG, $META

SME lending & BNPL: $AFRM, Stripe Capital, $PYPL Credit

Government & utilities: driver’s licence, tax payments, electricity, water — all inside the same app

Now imagine logging into one single app, one ID, one wallet where you can pay your bills, book a trip, advertise your store, buy groceries, or apply for a small business loan, all without leaving the platform.

Add AI on top of it.

It knows your full transaction history, spots fraud instantly, manages your cash flow, underwrites credit, and suggests better financial moves. It becomes your operating system for daily life.

That’s exactly what Kaspi ($KSPI) has already built in Kazakhstan, while most Western markets are still trying to stitch together a dozen different apps to do the same thing.

Investment Thesis

Kaspi’s biggest strength is its three-sided network effect, connecting consumers, merchants, and payments under one roof, with Kaspi Pay at the core.

The more people use the app, the more merchants join the marketplace.

As more merchants accept Kaspi Pay, the app becomes more useful for consumers.

Each side strengthens the other and that flywheel creates a strong moat.

Merchants can grow their business directly through Kaspi, take loans, advertise, and expand their reach. Consumers can shop, pay, and get instant financing. Every part of the ecosystem talks to each other, creating a level of integration that’s rare even by global standards.

I see limited downside here, backed by predictable earnings, strong free cash flow, and zero need for outside capital.

Even after the Hepsiburada $HEPS acquisition, Kaspi still sits on a net cash position.

At today’s valuation, you’re looking at a cash-rich, dominant platform trading at single-digit earnings multiples

Business Overview

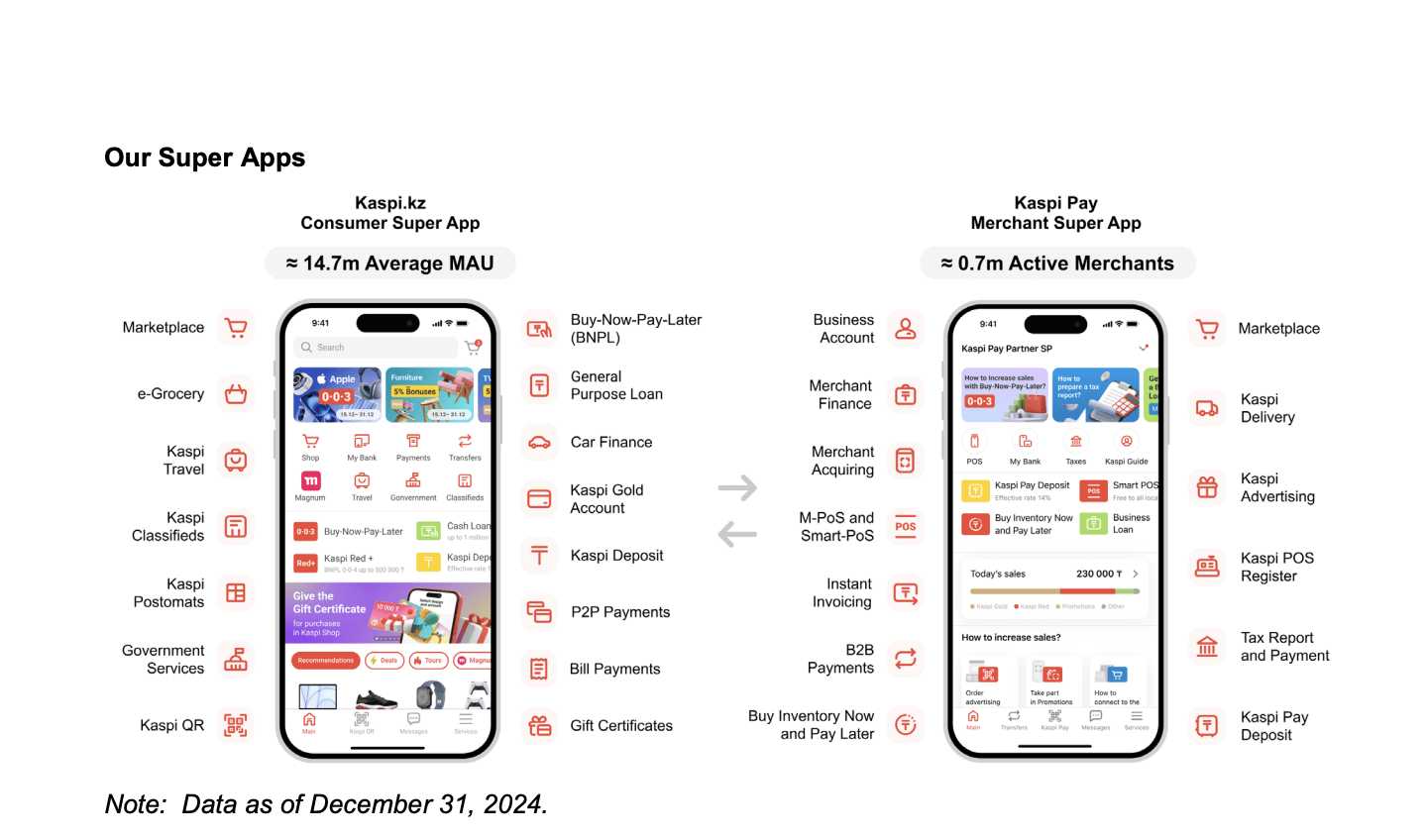

Kaspi.kz runs two main apps:

Kaspi Super App (Consumer) — used by millions daily for payments, shopping, travel, transport, and finance.

Kaspi Pay (Merchant) — built for entrepreneurs and SMEs, offering QR payments, delivery, accounting, loans, and advertising.

Engagement is through the roof: on average, users make 75 transactions per month inside the app — that’s how deeply embedded it is in daily life.

Kaspi now owns 66.35% of Hepsiburada in Türkiye and is acquiring Rabobank A.Ş, which gives them a local banking licence. Türkiye is early-stage, but if they replicate even half of what they’ve done in Kazakhstan, it’s meaningful upside.

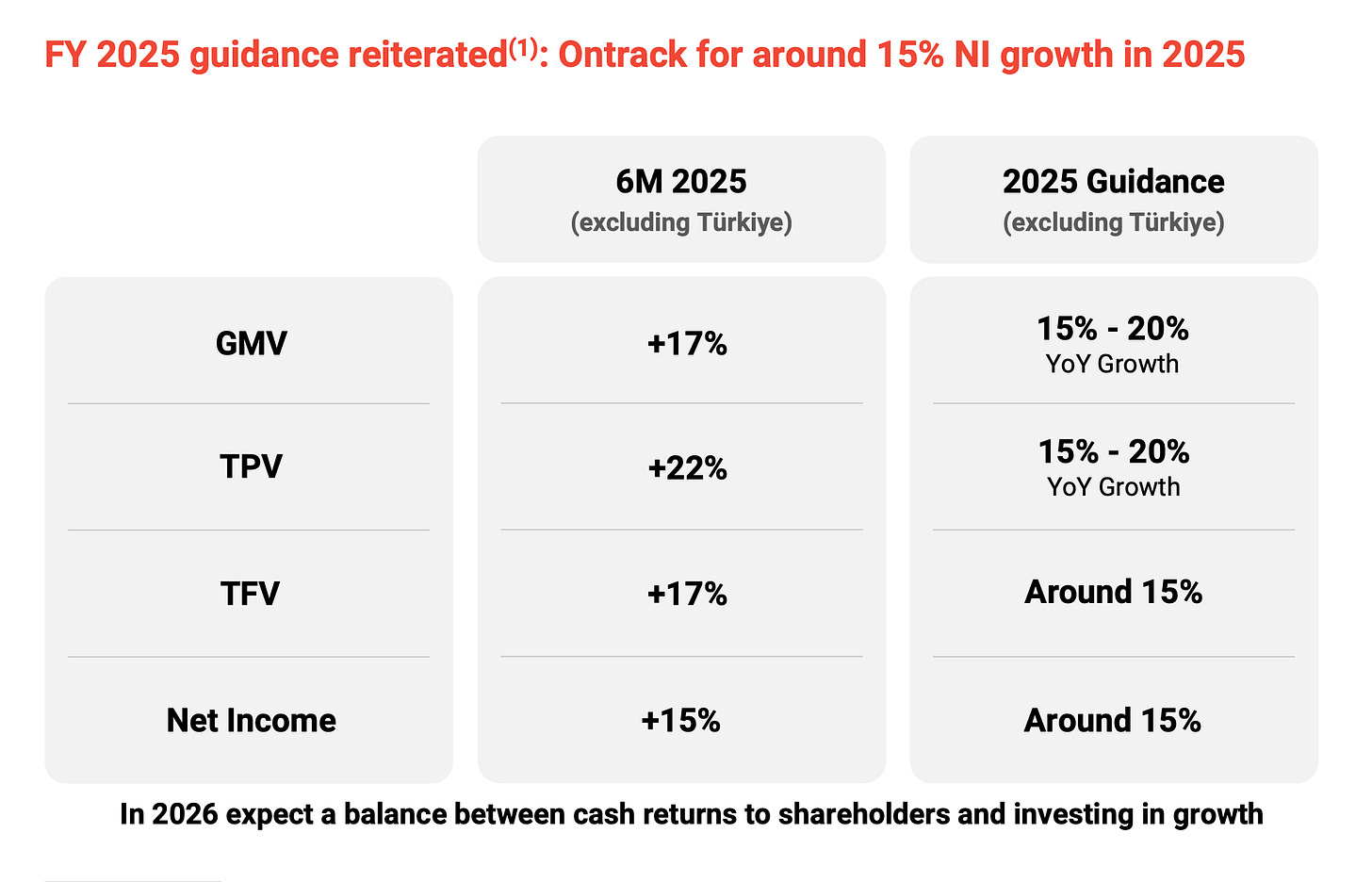

1H 2025: Solid Growth, Despite Headwinds

Headline results (excluding Türkiye):

2Q 2025 revenue: KZT 734B (+20% YoY)

2Q 2025 net income: KZT 276B (+14% YoY)

1H 2025 revenue: KZT 1.4T (+20% YoY)

1H 2025 net income: KZT 535B (+15% YoY)

Including Türkiye:

1H 2025 revenue: ≈ KZT 1.8T ($3.5B)

1H 2025 net income: ≈ KZT 513B ($987M)

By segment:

Payments: TPV +21% YoY; revenue +16%; net income +19%.

Marketplace: GMV +15%; revenue +25%; take rate 10%. e-Grocery up 57% YoY. Smartphones weaker due to IMEI registration law, but excluding smartphones, e-commerce GMV grew 31% YoY showing strong core demand.

Fintech: TFV +17%; revenue +21%; net income +8%. Deposit rates rose 26% YoY

Capital Allocation & Türkiye

2025 is an investment-heavy year:

The final $526.9M payment for Hepsiburada closed in July. ( $HEPS )

The Rabobank A.Ş acquisition in Türkiye is expected to close in 2H 2025, with roughly $300M in capital deployed.

From 2026 onward, Kaspi plans to balance growth investments with capital returns, and I expect the company to start paying dividends to shareholders.

Valuation — Growth

Kaspi earned around $2.0B in 2024.

Assuming 15% net income growth, that puts:

2025E net income: $2.3B

2026E net income: $2.65B

Shares outstanding: 190M

At a $15B market cap ($79/share):

P/E 2025E: 6.5×

P/E 2026E: 5.7×

Net cash: $2B +

You’re paying mid-single-digit earnings multiples for a super app that’s still growing mid-teens, with a clean balance sheet.

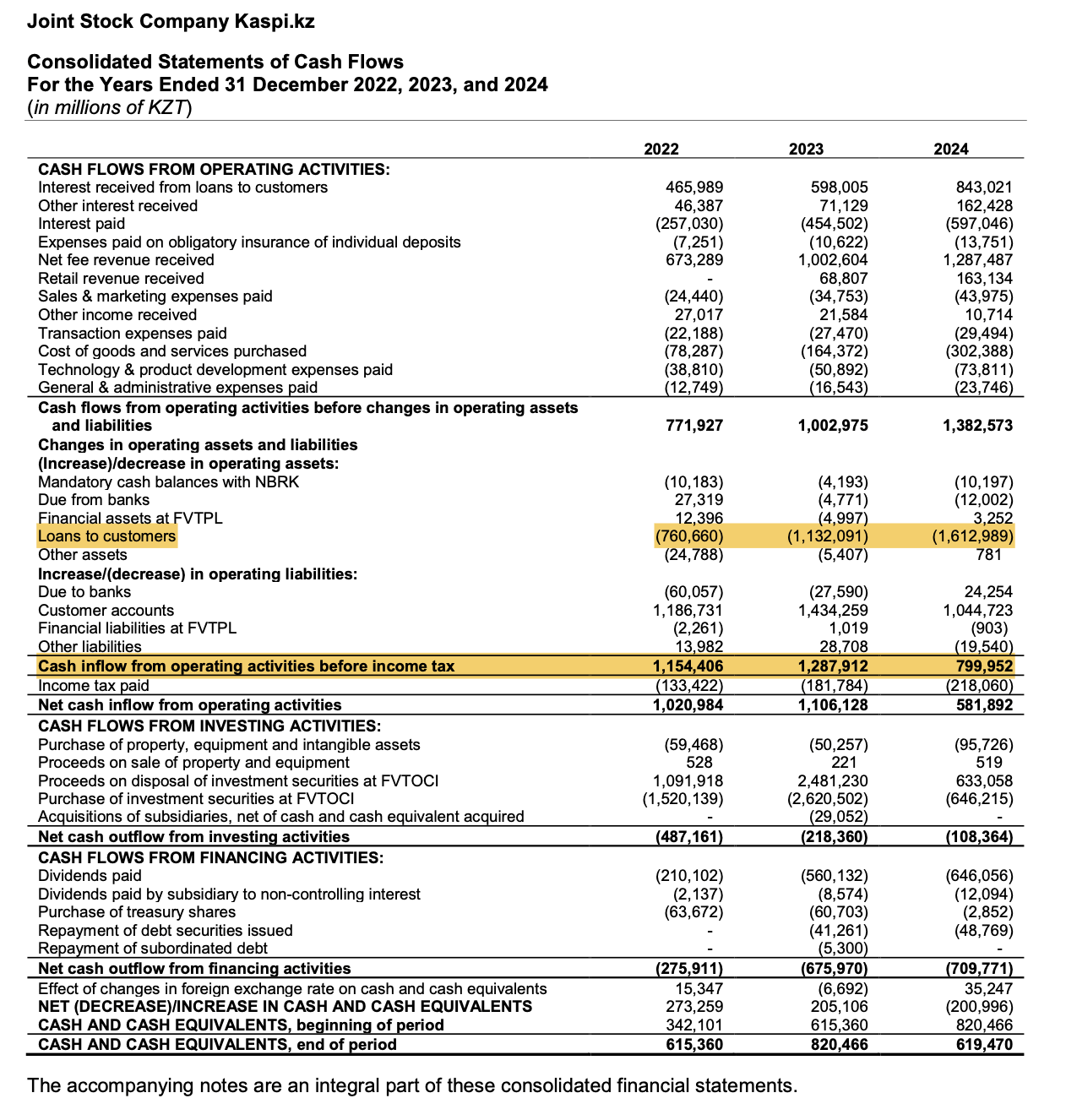

On a free cash flow basis, adjusted for loan outflows, Kaspi’s core FCF is around $2.9B, which puts it at roughly 5× core FCF.

Even using conservative assumptions, growth slowing from mid-teens to high single digits by the end of the decade the stock looks deeply undervalued.

You’re basically paying value-stock multiples for a business with growth, durability, and compounding power.

Risks

I think the biggest risk here is geography. Kazakhstan sits close to Russia, and that proximity will always keep a small discount on the stock — it’s just part of investing in the region.

Regulation and deposit costs are the other two things to watch. The new 10% tax on government bond income and higher reserve requirements already shaved about 200 basis points off margins this year. Rising rates also pushed deposit costs up roughly 26% year over year. It’s not alarming, but it’s worth keeping an eye on if the rate environment stays elevated longer than expected.

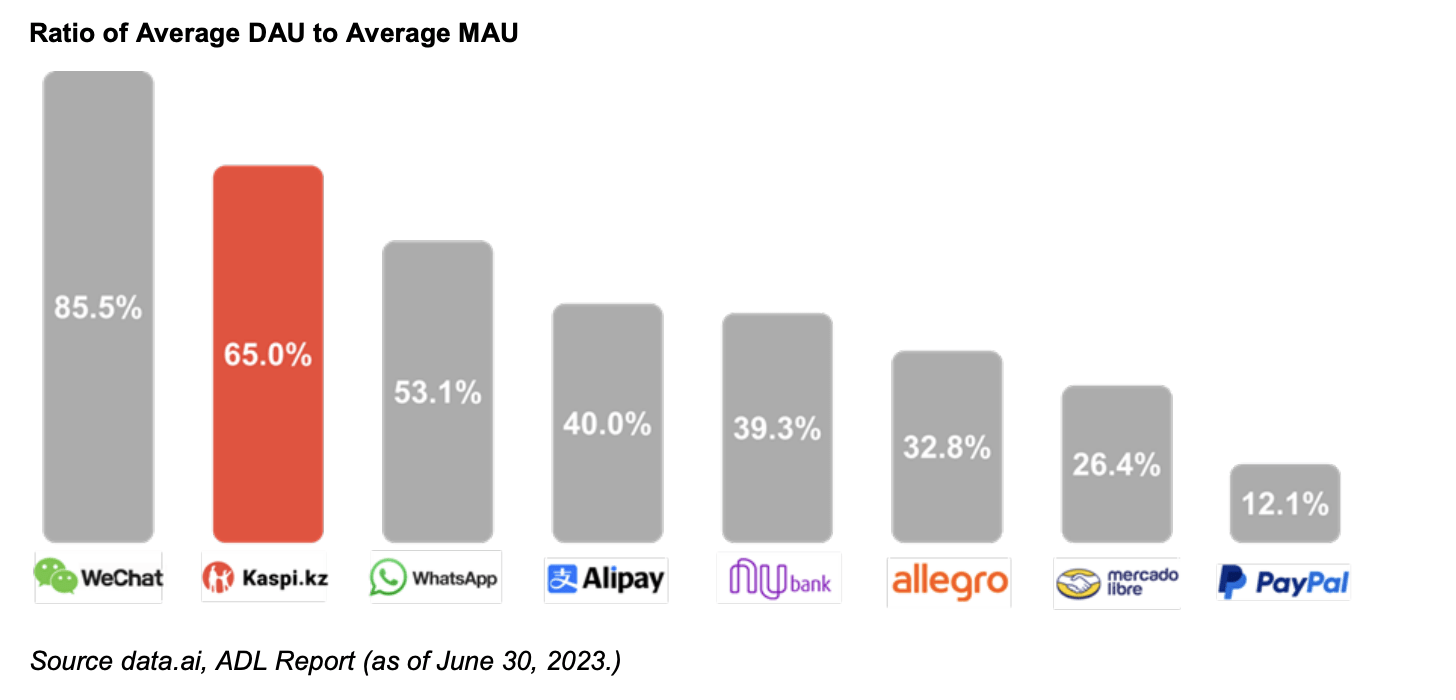

As for competition, I’m not worried. If you look at Kaspi’s daily and monthly user data, they’re far ahead of Halyk Bank or anyone else in digital engagement.

The other area that needs time is execution in Türkiye. Hepsiburada is improving, but integrating the banking operations through Rabobank A.Ş will take work. It may weigh on margins in the short term, but the long-term opportunity looks meaningful.

Takeaway

Kaspi is one of the few true super apps in the world a fintech, marketplace, and bank, all rolled into one.

You’ve got:

Proven management with a compounding mindset.

A three-sided platform built around real user needs.

Predictable earnings and strong free cash flow.

A fortress balance sheet with net cash.

Insider ownership and minimal stock-based comp.

DisclaimerThe author of this analysis is a current shareholder in Kaspi.kz ($KSPI). The views and opinions expressed here are personal and for informational purposes only. This does not constitute financial or investment advice. All investment decisions should be made based on your own research and due diligence.

When you take into consideration the high inflation in Kazakhstan, what do you consider the real $ value earnings growth rate for Kaspi?

Good summary but for FCF you should also adjust for the customer account inflows as this money does not belong to the shareholders of Kaspi.