I have added Gartner to the portfolio. I like businesses that are easy to understand, have a wide moat, and generate plenty of cash.

Gartner ticks all those boxes. a strong competitive advantage, excellent cash flow, and a price that offers a margin of safety.

Here is a look at how the business actually makes money, and why I think it is currently selling for less than it is worth

1. The Business Model: High Margins and Upfront Cash

Gartner sells research and advice to corporate executives.

Operating Leverage: They produce intellectual property (reports and data). Once a report is written, the cost to sell it to one client or one million clients is the same. This allows for very high profit margins on every new subscriber.

Recurring Revenue: Most of their revenue comes from multi-year subscriptions, making the business predictable and stable.

Negative Working Capital: Clients pay their bills upfront at the start of the contract. This means Gartner collects the cash before they deliver the service, giving them a constant “float” of money to invest or return to shareholders.

2. The Competitive Advantage

Their primary product (the “Magic Quadrant”) has become the industry standard for rating technology vendors.

For Buyers: Corporate executives rely on these ratings to justify billion-dollar spending decisions to their boards. It provides them with necessary independent verification.

For Sellers: Technology companies effectively must subscribe to Gartner to understand how to be rated. If they are not rated, they risk being invisible to buyers. This creates a self-reinforcing loop that is very difficult for competitors to break.

Imagine you’re the head of technology at a big company, and you’re facing a high-stakes, $50 million decision on what new software to buy

if you pick the wrong software, the company loses money, and your job is at risk.

If you pick the right software, you just did your job.

So, what do you do? You pay Gartner a subscription fee to see their report cards (the famous “Magic Quadrant”).

If Gartner says a software is a leader, and you buy it, you are safe. Even if the software fails, you can tell your boss, “I bought what the experts recommended.”

That is why managers are happy to pay Gartner’s fee: It is a small price to pay for peace of mind.

It is essentially “Career Insurance” for executives.

In summary:

It’s a Subscription: They collect money every year, recurring like a utility bill.

It’s Highly Profitable: They write a report once and sell that same PDF to 15,000 different clients.

Cash Upfront: Customers pay the bill at the start of the year (negative working capital).

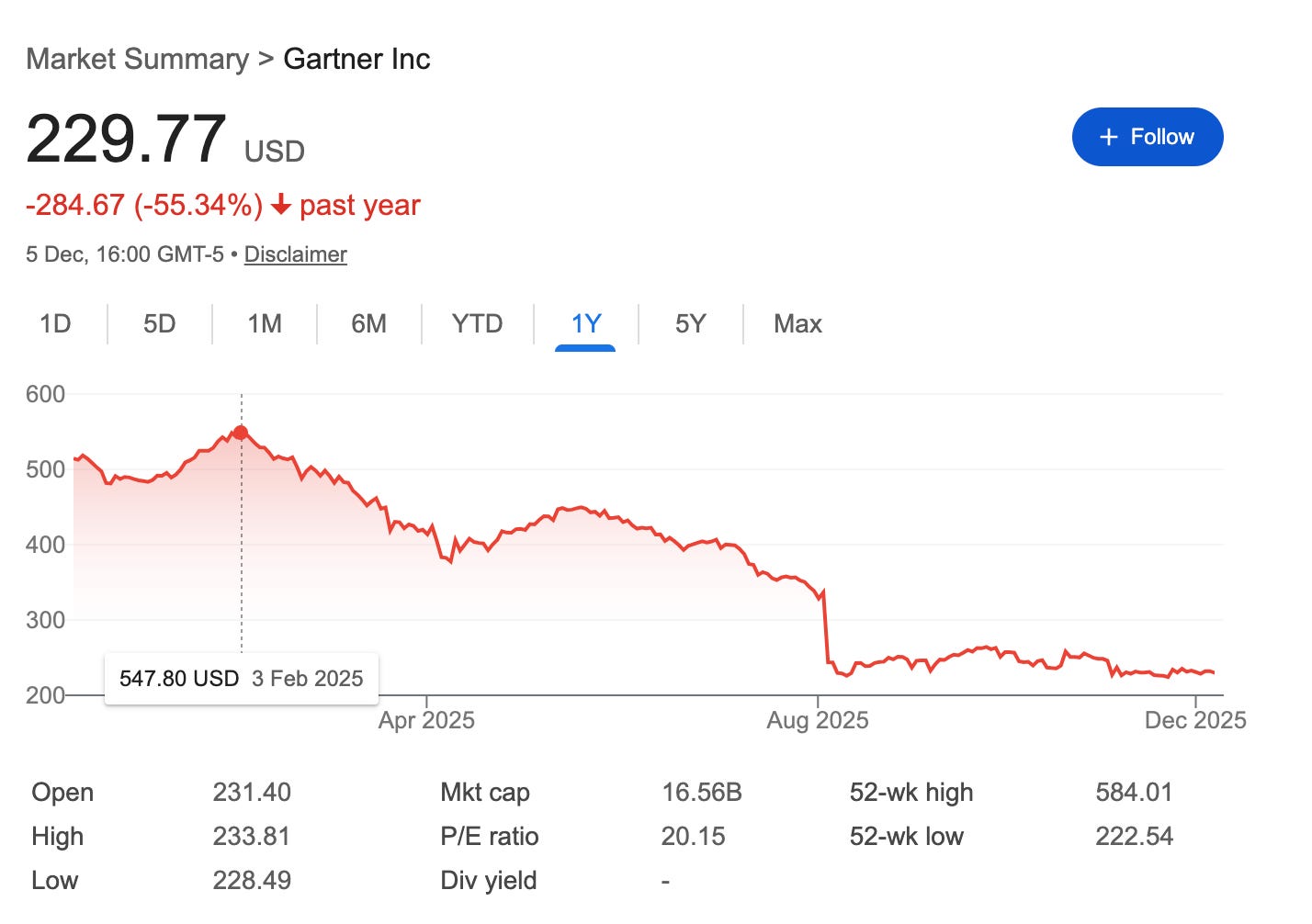

3. Why Is It On Sale?

The stock is currently trading at a discount because of two market fears:

Cyclical Headwinds: Gartner charges per user. As the tech sector has laid off employees recently, the number of paid subscriptions has temporarily dropped.

Structural Fear (AI): Investors worry that Artificial Intelligence will replace the need for human analysts, destroying Gartner’s pricing power.

Disclaimer: The author holds a long position in Gartner (IT). This content is for informational purposes only and should not be considered professional financial advice. All investments involve risk.