IRES REIT: Buying Dublin Apartments for 60 Cents on the Euro

Deep Dive #10

If you know Ireland, the housing shortage needs very little explanation.

The economy is strong. Ireland has a high concentration of multinational activity in tech, pharma, medical devices, and aircraft leasing, supported by a young workforce and strong export growth. Employment levels are high, wages have grown, and net migration continues to add demand.

Housing supply remains tight.

Any decent rental listing is gone instantly. Same with buying. Supply is not keeping up, and everyone feels it.

That’s the backdrop for $IRES, the largest residential landlord / residential platform in Ireland, with 3,652 homes, mostly in Dublin.

Occupancy is basically full: 99.5%.

It’s a simple model: own apartments in the most supply-constrained part of the country and collect rent.

The business has

3,652 units (mostly Dublin)

99.5% occupancy

99%+ rent collection

Average monthly rent around €1,823 across the portfolio

Net rental income margin: 78% (up 150bps)

The stock is down from €1.73 at the 2022 peak to around €0.93 today, as we head into the end of December 2025.

1) Interest rates repriced property values

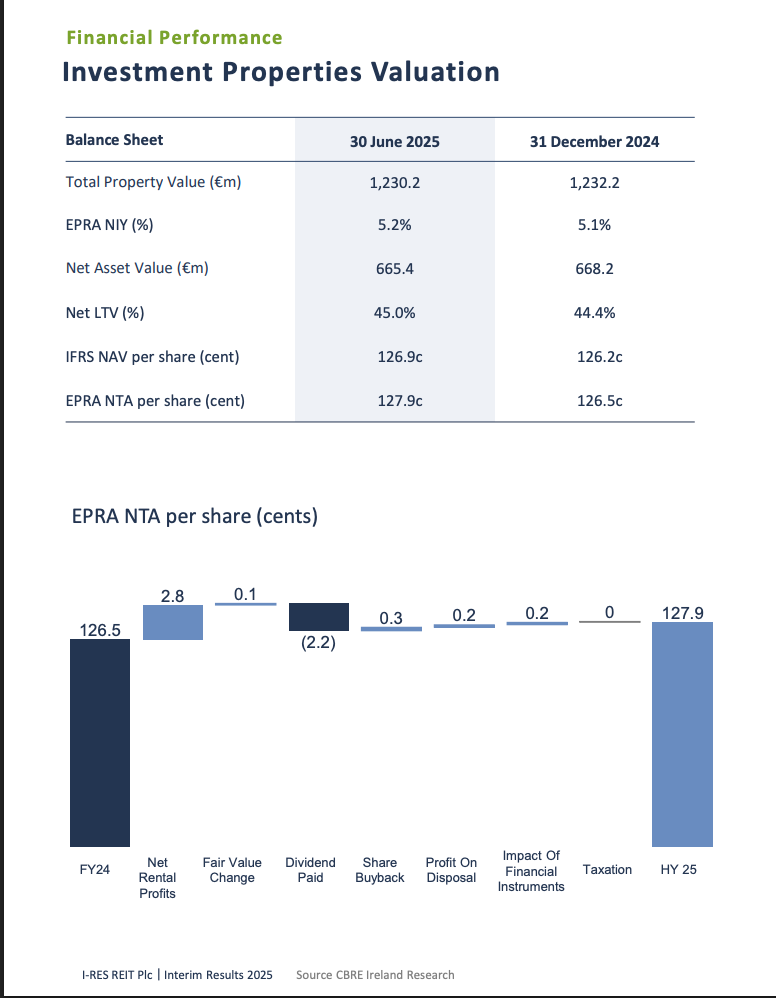

When rates rise, property yields expand, and values fall. IRES even shows that Dublin PRS yields expanded 115 bps since Dec 2021, implying roughly a 32% decline in capital values.

So even if rents stay strong, your asset value can get marked down.

2) Rent controls and regulatory uncertainty

Ireland’s rent control framework has been a big overhang. IRES directly says restrictive rent regulations disproportionately impacted valuations.

You can feel this on the ground too:

Private landlords are leaving.

Costs are up.

And the market assumes rental regulation will remain restrictive.

What’s changed

Two things are starting to tilt the setup.

1) Rate cuts = less pressure on valuations

IRES notes that the ECB has already cut rates multiple times since peak inflation (they reference eight cuts between June 2024 and June 2025).

Lower rates help in two ways:

cheaper funding over time

less pressure on property yields / capital values

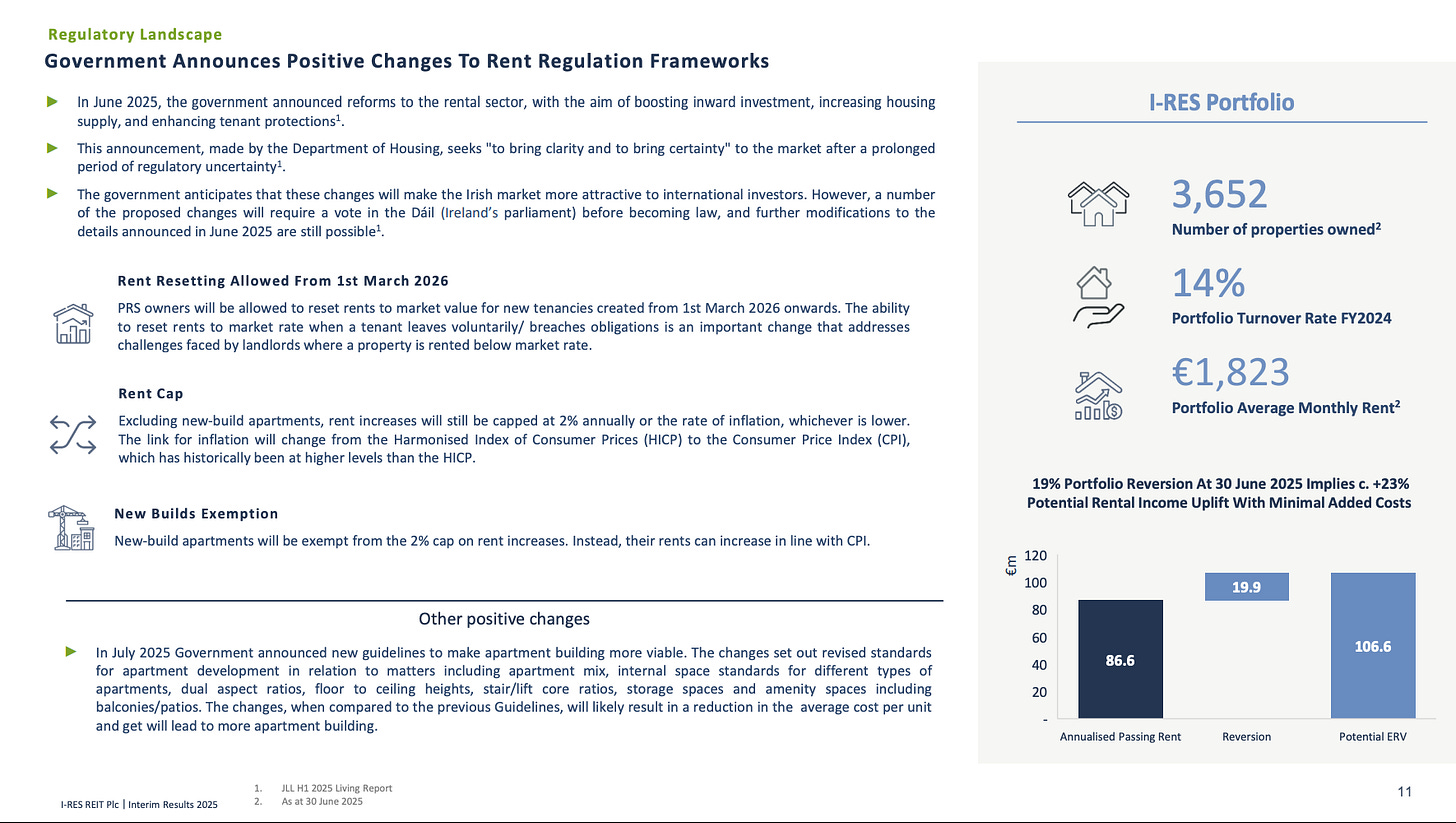

2) The regulatory tone is shifting

In June 2025, the government announced reforms aimed at more “clarity and certainty”.

And the big practical point is this: from 1 March 2026, rents can reset to market for new tenancies (in the situations covered).

That matters because IRES believes the portfolio is under-rented vs market, they show 19% reversion.

Rent gap math

IRES currently generates approximately €86.6m in annualised rent.

Management estimates around 19% rent reversion across the portfolio as rents reset to market levels over time. This implies a potential rent gap of roughly €19–20m once turnover and resets occur.

That gives:

Current annual rent: €86.6m

Estimated rent reversion: €19.9m

Implied annual rent: €103–106m

Assuming no additional asset sales, this represents the rental income capacity of the existing portfolio.

Against the current equity market capitalisation of €488m, this implies a gross rental yield in the low-20% range, before operating costs, interest, or reinvestment.

The Investment Thesis

When inflation reached close to 9% and maintenance costs increased sharply, IRES could only increase rents by about 2%. In real terms, earnings declined.

I generally prefer businesses with pricing power against inflation and competition. IRES does not fully meet that criterion, it operates within a regulated framework.

That said, it owns real assets in established Dublin locations, maintains 99.5% occupancy, and generates predictable rental income. Demand for rental housing remains high, and supply remains limited.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The views expressed here are my own and should not be taken as a recommendation to buy or sell any security. I do not currently hold a position in the stock mentioned in this report. Please conduct your own due diligence or consult a certified financial advisor before making any investment decisions.