Nike NKE 0.00%↑ stock has taken a hit recently, dropping about 10% and bringing the company’s total value down to around $88 billion. It is back to April’s low of around $55 per share, a level it last hit during the height of tariff uncertainty. For a company that is usually expensive to buy into, this looks like a potential opportunity. But before deciding, we need to dig into the numbers and structural pains. Note that this isn't a full "deep dive", it's a review of the quarter and the outlook, with a specific focus on valuation and current problems.

North America: Selling More, Earning Less

Nike’s biggest market, is a mix of good and bad news.

The good news is that sales are finally growing again. This is a huge signal that the brand is healthy. The bad news is that they made less profit on those sales. There are two main reasons for this. First, they had to discount old inventory to clear it out. Second, and more importantly, tariffs hit them.

Management said these tariffs took a massive bite out of their profits. In fact, if you removed the cost of those tariffs, their profit margins would have actually gone up, not down. This tells me that the business operations are improving, but government fees are eating up the gains.

Greater China

While North America is showing signs of life, China remains a major weakness. Sales there dropped 17%. The company is struggling with intense local competition and mismanagement in the region.

To understand how serious this is, just look at Lululemon. While Nike’s sales are shrinking double-digits in China, Lululemon is growing about 25% in the same market. Nike stock is priced like a fast-growing company, but right now, competitors are the ones actually delivering that growth overseas. This difference is the main reason I currently prefer Lululemon’s position.

The Numbers at a Glance

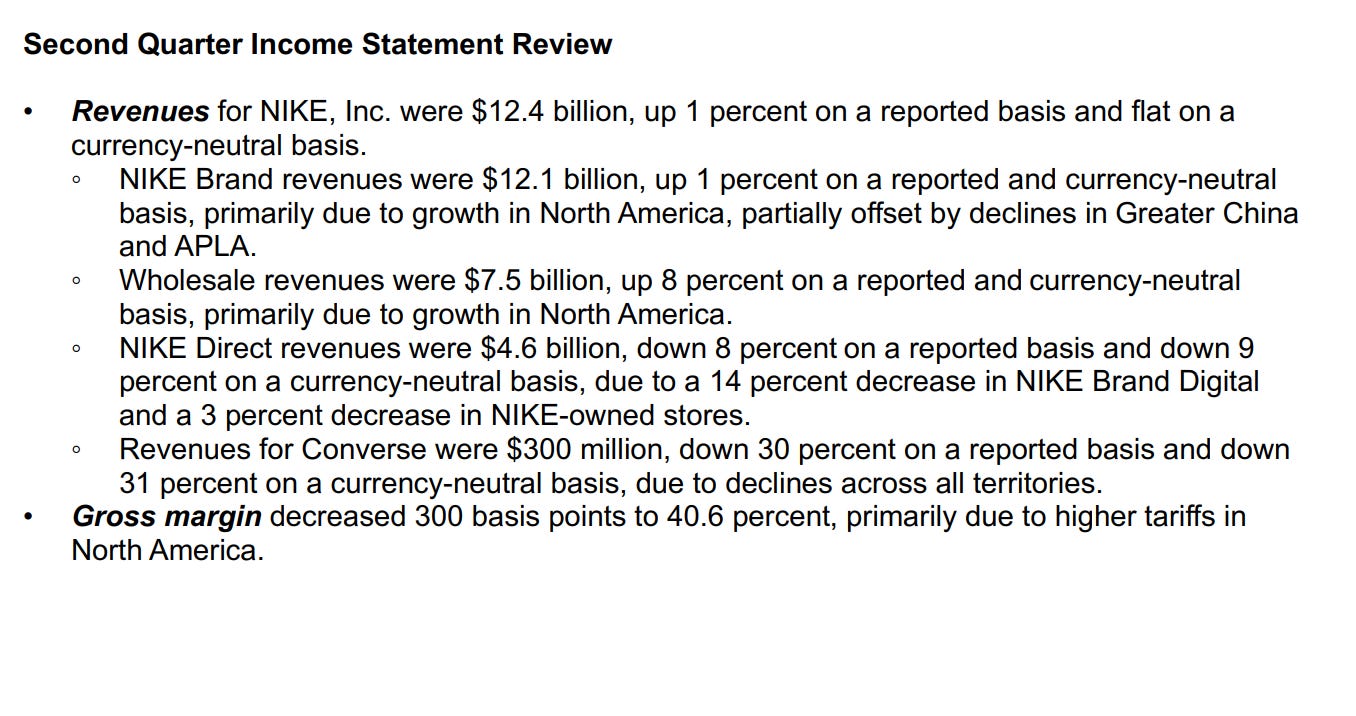

Revenue: Sales were essentially flat at $12.4 billion.

Profit Margins: Dropped significantly, mostly due to the tariffs I mentioned.

Inventory: They have successfully lowered their stockpile of unsold goods, which is a good sign.

Cash: Their cash pile shrank by about $1.4 billion because they spent money on dividends and buying back their own shares.

The Outlook: More Pain Ahead

Nike warned that the next few months will still be tough. They expect sales to drop slightly in the upcoming quarter. They also expect profit margins to fall again, almost entirely because of the tariff costs. Without those taxes, they would be making money, but as it stands, their profits will be squeezed. On top of that, they plan to spend more money on marketing to try and boost demand.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. The views expressed here are my own and should not be taken as a recommendation to buy or sell any security. I do not currently hold a position in the stock mentioned in this report. Please conduct your own due diligence or consult a certified financial advisor before making any investment decisions.